The Importance of Succession Planning in Credit Unions

Succession planning is essential for credit unions to ensure smooth leadership transitions and maintain operational stability. With the recent NCUA Succession Planning Rule, all federally insured credit unions are now required to have a formal succession plan. But how prepared are credit unions to meet this new requirement?

During a recent webinar about the new Succession Planning Rule, 70 credit unions participated in poll questions assessing credit unions' readiness and resulting in some key insights.

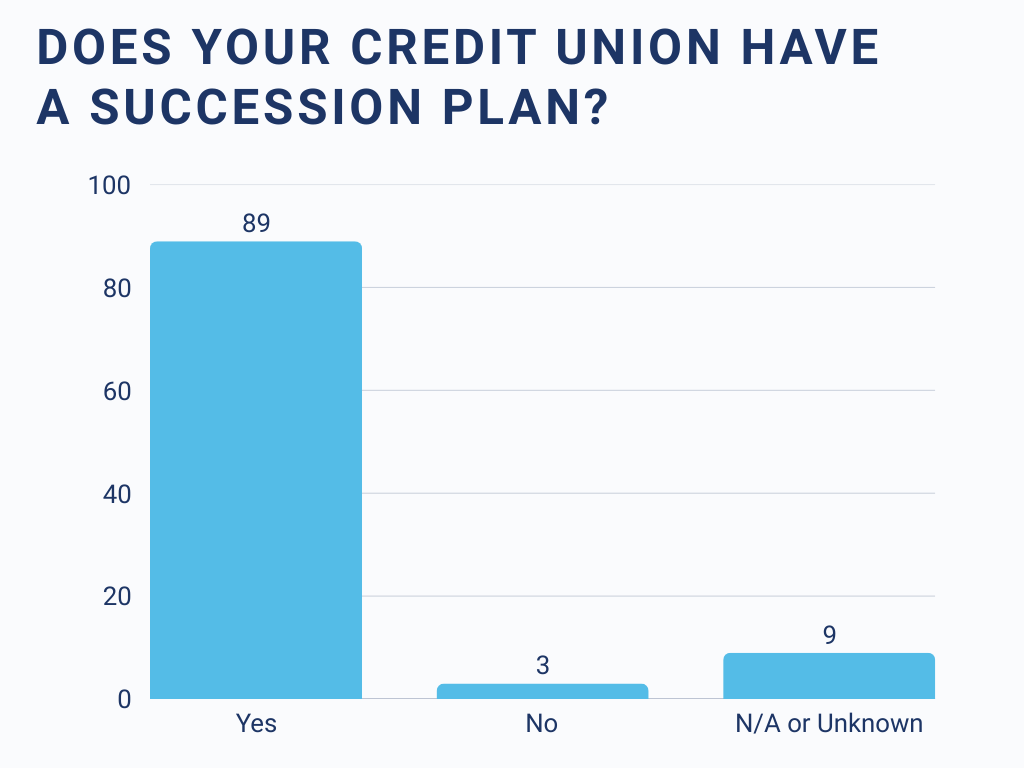

How Many Credit Unions Already Have a Succession Plan?

We asked credit unions whether they currently have a succession plan in place, and 89% said they do have a succession plan in place.

While most credit unions appear to be prepared with a plan in place, the specifics of the succession planning rule may prompt credit unions to reevaluate their current plans to ensure compliance. Let's look into this further in our next two sections.

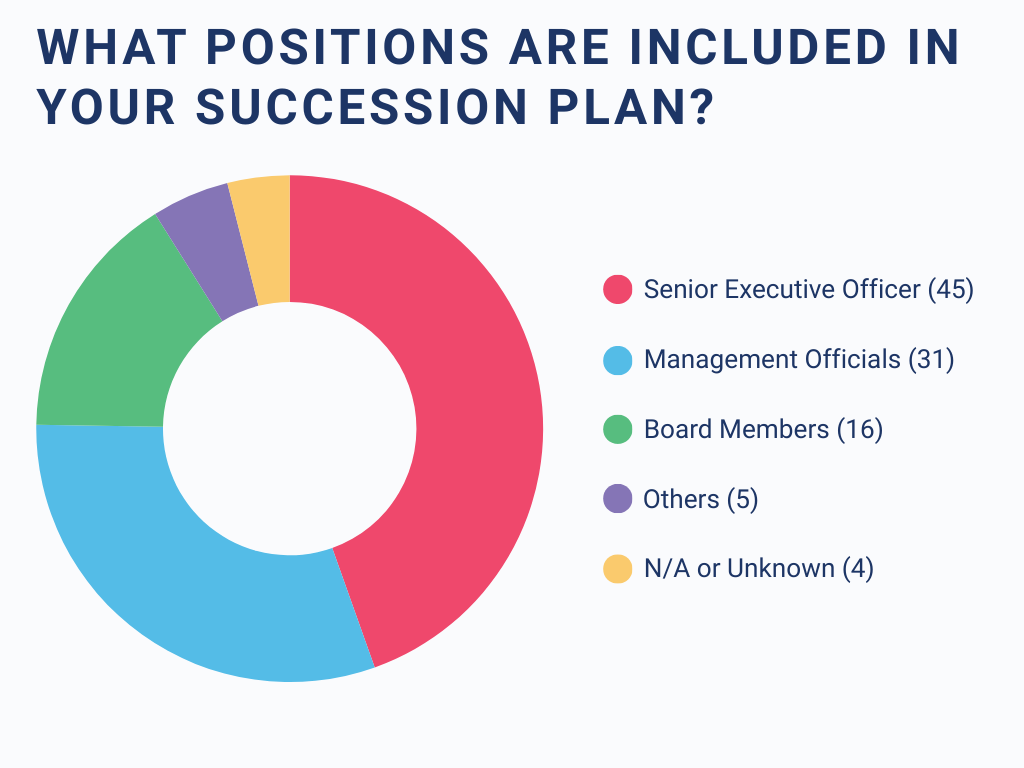

Who is Covered in These Succession Plans?

When we asked our survey participants about the positions included in the succession plan, 45% included Senior Executive Officers and only 16% included Board Members.

These findings suggest that while some succession plans cover leadership roles, credit unions may need to expand their planning to encompass additional key personnel.

The NCUA's Succession Planning rule states that credit unions should include, at a minimum, Board Members, Management Officials, Assistant Management Officials, Senior Executive Officers, and "any other personnel the board of directors deems critical given the federal credit union's size, complexity, or risk of operations."

The last line leaves things fairly broad and ambiguous, but the rule commentary explains this could include new or specialized positions. As an example, if you work in a small credit union with limited cybersecurity staff, then you may want to include some of those key personnel in your succession plan.

In short, credit unions should ensure their plan includes all critical roles, not just top executives, to maintain leadership continuity and minimize disruption.

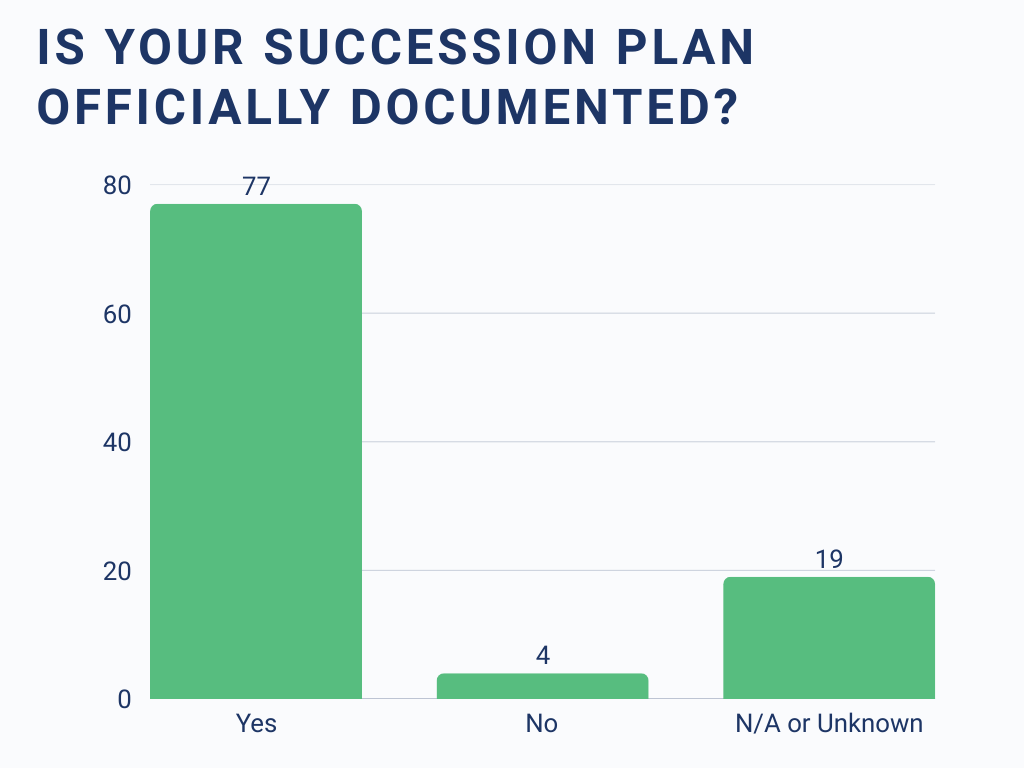

Are Succession Plans Properly Documented?

When asked "Is your succession plan officially documented somewhere?", three out of four participants said "Yes."

Some credit unions have shared concerns about documenting their succession plan due to its sensitive nature, which is completely understandable. Our recommendation is to not create a single stand-alone document but instead create several documents that are available to different groups of people, based on data confidentiality labels.

Private Documentation

Private documentation might include sensitive policy information, succession procedures, cross-training plans, or an emergency order of succession. While it may not be available to all team members in the organization, these types of information would be great to document in your organization's business continuity plan.

Confidential Documentation

Confidential documentation could contain the named successors in the event of leadership change, performance evaluations, job offers and retention plans, and meeting minutes from sensitive succession planning meetings. This level of succession planning detail should only be accessible to top leadership of the company, and you may want to include HR to help implement changes as they happen within the organization.

General Access Documentation

General access documentation might contain non-sensitive policy information, cross-training opportunities, career path and development programs, and organization charts. These documents and information can be distributed to the company employees as you see fit, and a great place to start is with your employee handbook.

Next Steps for Credit Unions

The data underscores that while some credit unions are well-prepared for the NCUA rule, others still have work to do. Here's what credit unions should focus on:

Develop a Succession Plan – If your credit union doesn't have one yet, now is the time to start. A clear leadership transition strategy is critical for regulatory compliance and business continuity.

Expand Coverage – Ensure that your plan includes not only senior executives but also board members, management officials, and other key personnel.

Formalize and Review – Having an informal plan isn't enough. Credit unions should document their plan and establish a review process to keep it up to date.

Tools to Help Develop a Succession Plan

For credit unions looking to enhance their documentation, Tandem offers succession planning tools within our Business Continuity Planning (BCP) software.

Tandem BCP comes with a succession plan policy template that is ready to be tailored to your organization, a cross-training matrix to help document your cross-training strategy, and an order of succession feature. All these features lead to a downloadable BCP document that can be passed to examiners, auditors, or senior leaders at your organization.

If you do not currently use Tandem BCP, visit our website or watch a demo to learn more and see the product in action.