On December 17, 2024, the NCUA Board approved a final rule on the topic of Succession Planning. The rule goes into effect on January 1, 2026. In this article, we will dive into this topic and answer the questions you might be asking, including:

- What is succession planning?

- Why is a new rule needed?

- How does this rule compare with existing requirements?

- Does the rule apply to me?

- What does rule require?

- What are my next steps?

- Are there any tools that could help my credit union with succession planning?

What is succession planning?

According to the NCUA's commentary on the proposed version of the rule, succession planning is:

"The process through which an organization helps identify, develop, and retain key personnel to ensure its viability and continued effective performance. It allows an organization to prepare for the unexpected, including the sudden departure of key staff."

In short, succession planning is a part of business continuity planning. It's about making sure the right people are in the right place when they are needed to support ongoing operations.

Why is a new rule needed?

While succession planning offers many benefits (e.g., minimizing disruptions, developing talent, creating opportunities for employees, etc.), failing to perform adequate succession planning can be devastating for an organization.

|

According to the results of a recent study performed by the NCUA, they found poor succession planning was either a primary or a secondary reason for 32% of credit union consolidations (e.g., mergers, acquisitions, etc.). While voluntary mergers "can be used by FICUs to achieve various objectives," the NCUA hopes to reduce the number of unplanned or forced mergers due to a lack of succession planning. |

In light of this information and the approaching retirement of the "baby boomer" generation, the NCUA believed a rule on succession planning would ultimately improve the safety and soundness of the credit union system.

How does this rule compare with existing requirements?

12 CFR Part 704.13(c)(2) requires credit union boards to ensure "qualified personnel are employed or under contract for all line support and audit areas, and designated back-up personnel or resources with adequate cross-training are in place."

12 CFR Part 749, Appendix B requires credit unions to prepare for catastrophic acts. Many credit unions already perform some level of succession planning as part of this process.

"Succession planning for key management positions" is also reviewed under the "Management" component of the CAMELS Rating System. Even though it is reviewed and considered as part of the ratings system, NCUA examiners did not have authority to issue findings for a lack of succession planning before this rule.

Additionally, the FFIEC IT Examination Handbook includes the following succession planning references.

- The Business Continuity Management booklet states management oversight should include "defining BCM roles, responsibilities, and succession plans" and that exercise and test plans generally include "identification of decision makers and succession plans."

- The Management booklet goes into further detail, stating "the board and senior management should consider appropriate succession and transition strategies for key managers and staff members. Some strategies include the use of employment contracts, professional development plans, and contingency plans for interim staffing of key management positions. Management should have backup staff for key positions and should cross-train additional personnel. The objective is to provide for a smooth transition in the event of turnover in vital IT management or IT operations."

All this information tells us one thing: The agencies believe succession planning is a good idea. The difference between the existing requirements and the new rule is that succession planning is now explicitly required for the purposes of long-term continuity.

Does the rule apply to me?

The rule applies to all federally insured credit unions (FICUs). This includes both federal credit unions (FCUs) and federally insured, state-chartered credit unions (FISCUs).

This is a change from the proposed rule, which excluded FISCUs, since they also have to comply with state laws for succession planning. The NCUA specifically addressed this though, including a clause that states FISCUs must comply with the rule, as long as it doesn't conflict with the state requirements. In those cases, the state requirements would take precedence.

In the proposed rule, the NCUA made a specific point to mention this rule applies to credit unions of all asset sizes. While smaller credit unions occasionally experience exemptions from rules like these, in this case, smaller credit unions are often the most susceptible to the exact outcomes this rule is working to avoid.

To help small credit unions (<$100 million in assets) comply, the NCUA issued a Succession Plan Template alongside the rule.

What does the rule require?

The rule itself is quite simple. It requires three things, which may already be happening at your credit union.

A Process: The Board of Directors must establish a process to ensure proper succession planning. This includes approving the written plan and reviewing the plan as needed - and - at least once every 24 months.

A Plan: A written succession plan must be developed that is suitable for the credit union's size, complexity, and risk. The plan must include the following elements:

- The titles of key positions covered by the plan (e.g., board members, management officials, assistant management officials, senior executive officers, other critical personnel, etc.).

- Anticipated position vacancy dates, if known (e.g., end of term, anticipated retirement date, announced departure date, etc.).

- The plan for recruiting candidates and permanently filling vacancies, in consideration of how the candidates are able to successfully fulfill the requirements of the position and of the credit union.

An Understanding: Within six months of joining the Board of Directors, board members must have "a working familiarity with" and be able to ask "substantive questions" about the credit union's succession plan.

What are my next steps?

If you work for a credit union, your next step would be to review your succession plans.

It is clear the NCUA believes succession planning is a worthwhile endeavor. If you have an existing succession plan, review the plan to ensure it addresses the key positions, outlines a plan for how to fill them in the event they become vacant, and clearly communicate this plan to key stakeholders.

Are there any tools that could help my credit union with succession planning?

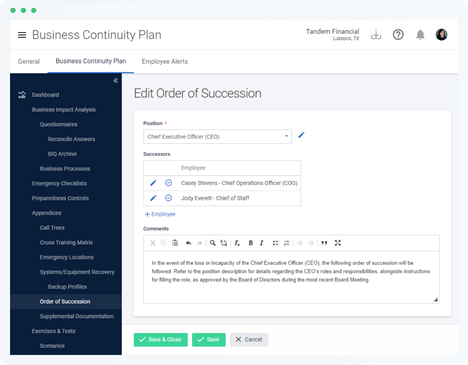

If your credit union currently subscribes to Tandem Business Continuity Planning, look no further. Tandem is ready to help you create and develop your succession plan with the use of the following features:

- Positions: Define the key positions at your credit union. Use the description field on each position to outline the job functions, necessary general competencies, and skills for those roles.

- Order of Succession: Identify the individuals who hold each key position, as well as a list of their planned successors. Use the comments field to document your strategies for identifying alternatives, filling vacancies, and other relevant details.

- Succession Plan Preparedness Control: Use and tailor this template succession plan to serve as the foundation of your own plan. With suggestions for implementation, maintenance, and training, this resource is designed to help simplify your process of compliance with this new rule.

- Revision & Approval Log: Present your plan to the Board of Directors and track the approval dates using the approval log. Share it as part of your full BCP, or create a custom document with only the order of succession.

If you do not currently use Tandem BCP, visit our website or watch a demo to learn more and see the product in action.