In February 2022, the NCUA published a proposed rule in the Federal Register on the topic of Succession Planning. In this article, we will dive into this topic and answer the questions you might be asking, including:

- What is succession planning?

- Why is a new rule needed?

- Would the proposed rule apply to me?

- What would the proposed rule require?

- What are my next steps?

- Are there any tools that could help my credit union with succession planning?

What is succession planning?

According to the NCUA's commentary on the proposed rule, succession planning is:

"The process through which an organization helps identify, develop, and retain key personnel to ensure its viability and continued effective performance. It allows an organization to prepare for the unexpected, including the sudden departure of key staff."

In short, succession planning is a part of business continuity planning. It's about making sure the right people are in the right place when they are needed to support ongoing operations.

Why was a new rule needed?

While succession planning offers many benefits (e.g., minimizing disruptions, developing talent, creating opportunities for employees, etc.), failing to perform adequate succession planning can be devastating for an organization.

According to the results of a recent study performed by the NCUA, they found poor succession planning was either a primary or a secondary reason for 32% of credit union consolidations (i.e., mergers, acquisitions, etc.).

According to the results of a recent study performed by the NCUA, they found poor succession planning was either a primary or a secondary reason for 32% of credit union consolidations (i.e., mergers, acquisitions, etc.).

In light of this information and the approaching retirement of the "baby boomer" generation, the NCUA thought it would be wise to revisit their existing rules on succession planning. What they found was current rules and guidance are not being implemented to their fullest extent.

For example, 12 CFR Part 704.13(c)(2) requires boards to ensure "qualified personnel are employed or under contract for all line support and audit areas, and designated back-up personnel or resources with adequate cross-training are in place."

Additionally, the FFIEC IT Examination Handbook includes the following succession planning references.

- The Business Continuity Management booklet states management oversight should include "defining BCM roles, responsibilities, and succession plans" and that exercise and test plans generally include "identification of decision makers and succession plans."

- The Management booklet goes into further detail, stating "the board and senior management should consider appropriate succession and transition strategies for key managers and staff members. Some strategies include the use of employment contracts, professional development plans, and contingency plans for interim staffing of key management positions. Management should have backup staff for key positions and should cross-train additional personnel. The objective is to provide for a smooth transition in the event of turnover in vital IT management or IT operations."

All this information tells us one thing: The agencies believe succession planning is a good idea. The problem is succession planning has not been applied as thoroughly as expected, demonstrated by many community credit unions having to choose to consolidate rather than fill vacancies.

Would the proposed rule apply to me?

The proposed rule would apply only to federal credit unions (FCUs). Federally insured state-chartered credit unions (FISCUs) are encouraged to adopt the principles described in the proposed rule, but are only required to comply with their state's laws for succession planning.

The NCUA made a specific point to mention this proposed rule applies to credit unions of all asset sizes. While smaller credit unions occasionally experience exemptions from rules like these, in this case, smaller credit unions are often the most susceptible to the exact outcomes this rule is working to avoid.

What would the proposed rule require?

The proposed rule itself is quite simple. It would require three things, which may already be happening at your credit union.

A Process: The Board of Directors must establish a process to ensure proper succession planning. This includes reviewing, updating, and approving the plan at least annually, as well as ensuring the plan is implemented effectively at the credit union.

A Plan: A written succession plan must be developed and include the following elements:

- Key positions covered by the plan.

- Necessary general competencies and skills for those positions.

- Strategies to identify alternatives to fill vacancies.

At a minimum, the list of key positions should include officers of the board, management officials, executive committee members, supervisory committee members, and members of the credit committee.

An Understanding: Within six months of joining the Board of Directors, board members must be familiar with and able to ask "substantive questions" about the credit union's succession plan.

What are my next steps?

If you are a federal credit union, there are two steps I encourage you to take:

- Comment on the rule. The NCUA has created a list of nine specific questions on which they are seeking input. Comments are welcome on the proposed rule through April 4, 2022.

- Review your succession plans. It is clear the NCUA believes succession planning is a worthwhile endeavor. If you have an existing succession plan, review the plan to ensure it addresses the key positions, outlines a plan for how to fill them in the event they become vacant, and clearly communicate this plan to all involved parties.

Are there any tools that could help my credit union with succession planning?

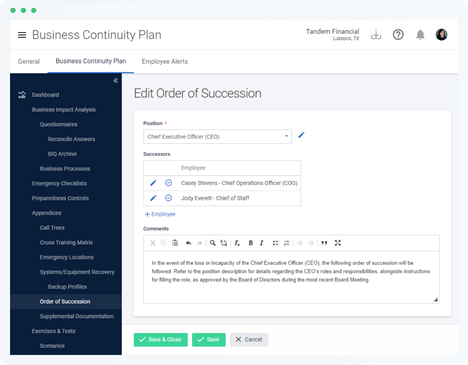

If your credit union currently subscribes to Tandem Business Continuity Planning, look no further. Tandem is ready to help you create and develop your succession plan with the use of the following features:

- Positions: Define the key positions at your organization. Use the description field on each position to outline the job functions, necessary general competencies, and skills for those roles.

- Order of Succession: Identify the individuals who hold each key position, as well as a list of their planned successors. Use the comments field to document your strategies for identifying alternatives and filling vacancies.

- Revision & Approval Log: Present your plan to the Board of Directors and track the approval dates using the approval log. Share it as part of your full BCP, or create a custom document with only the order of succession.

If you do not currently use Tandem BCP, visit our website or watch a demo to learn more and see the product in action.